“I visited the workshop, listened to feedback and you can grabbed a go, she told you. It ensured I experienced money stored.”

Get in on the fight for reasonable housing

Brand new Lugenia Burns Guarantee Focus on 47th Street during the Bronzeville are attempting to stop the fresh exclude to the rent manage inside the Illinois as a result of new Elevator new Exclude Coalition. The fresh center’s manager movie director, Roderick Wilson, mentioned that the new coalition isn’t regarding the preventing rents away from becoming elevated as a whole.

The heart is additionally trying to give clients and you will residents along with her to create sensible construction having lower-to-moderate-income citizens. Included in the Chicago Property Step, the company try pressing having an ordinance who does carry out the latest requirements to have reasonable homes waitlists who prioritize property against persistent homelessness. The fresh new ordinance could establish a great universal program to greatly help customers register for sensible construction. The il Construction Initiative is also moving having an alternate ordinance who does push a property owners to repair and you may complete unused devices.

To obtain involved, join the Chi town Housing Initiative’s strategy email list on the its web site and look the container that fits your needs. To possess issues, name (630) 387-9387. To contact the fresh new Lugenia Injury Promise Heart, telephone call (773) 966-4674 or upload an email because of the website.

Begin a houses co-op

Homes cooperatives have existed in the il for many years but partners people may already know it can be found, what they are, otherwise ways to get you to definitely become. In the good co-op, participants tend to broke up possession of a multiple-product building and purchase a percentage providing you with them the proper to take a unit.

David Feinberg, brand new movie director of coaching and you may knowledge transfer on Chicago Community Loan Funds, told you co-ops have usually become recognized as a way to preserve sensible property and to create a path in order to homeownership.

The fresh finance, that gives support and financing getting co-ops, falls under one’s heart having Mutual Control, and this aims to give anyone details about existing cooperatives and you will information for doing you to definitely, including setting-up government preparations and you may cost management templates. The center may connect owners that are trying to initiate her co-op to help you established of them.

For anyone having curious, Feinberg said, the center to own Common Possession is a superb stopping point. We have an information and you may intake survey that helps united states assess exactly what your hobbies is and just how we could become of top solution.

For more information, email address the center to own Shared Ownership from the plus the Chicago Society Loan Fund on otherwise name (312) 2520440.

Info for lots more instant housing needs

The new Lawyers’ Panel to have Greatest Homes – A non-cash law practice inside il that have a pay attention to reasonable-and-reasonable income tenants. A few of the services are pre-eviction advice about illegal electric shut-offs and you will free legal logo inside the eviction cases for insecure renters, including anybody coping with a handicap, elderly people and you will single moms and dads. (312) 347-7600

Homelessness Prevention Call center – The metropolis works which cardio. Citizens are advised to telephone call 311 and ask for Short-Title Assist. From there, they should be connected to the call centre, in which capable score information regarding various area software.

StreetLight Chi town – A venture run of the Chicago Coalition toward Homeless and you can More youthful Invincibles. The site posts places of disaster beds, wellness clinics, drop-during the facilities and you will day shelters for example Matthew Home Chicago.

Frederique Desrosiers, Charlene Rhinehart and you can Erica Scalise try 2022 Summer Civic Reporting Fellows. Jerrel Floyd is actually Town Bureau’s involvement journalist level advancement and you may segregation within the Chi town. You could come to your having resources at the

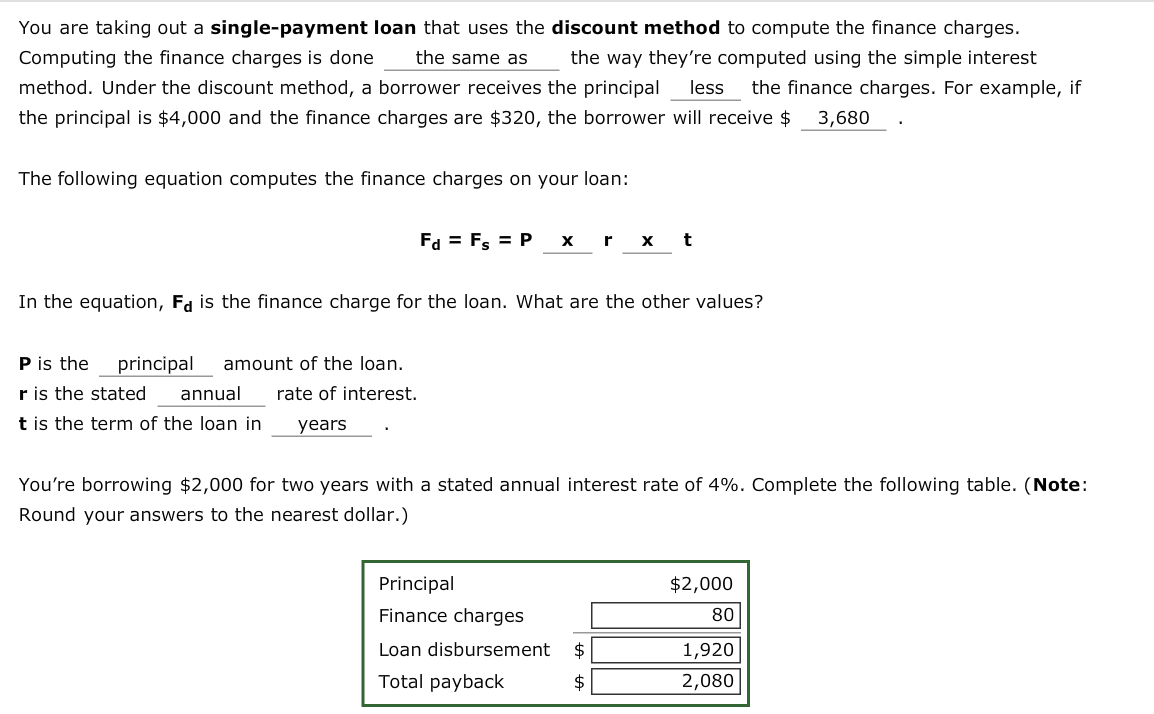

MEMBER’S 1st Investigations – NACA

- Publication

Transcription

MEMBER’S Initial .Financial AssessmentINCOMENumber from adults getting income who can alive inyour future domestic.Personal Monthly Gross Incomes W-dos HourlyExample: fifteen by the hour times forty occasions per week,minutes 52 weeks for yearly income, divide of the twelve forgross month-to-month income.Monthly Revenues W-2 Domestic SalariesMonthly Revenues W-dos Family CommissionMonthly Revenues Self-working IncomeTotal Disgusting Month-to-month Income:DEBTS(automobile costs, figuratively speaking, credit card minimumpayments, etc.)Overall Monthly Bills:Restrict Sensible PAYMENTCurrent RentHousing Ratio:Proliferate complete gross month-to-month earnings (Row eight) by the 31%(31% of gross month-to-month earnings ‘s the maximumthat may go with the the homeloan payment)Obligations Proportion:Re-double your disgusting monthly earnings (Row eight) by the 40% https://paydayloanalabama.com/smoke-rise/,and you will subtract the month-to-month expense (Row 8) (40% away from yourgross monthly earnings without most of the monthly debtobligations is your limit payment)Limit Sensible Commission:Take the low out-of: Rent (Line 10), Property Proportion(Line eleven), otherwise Personal debt Proportion (Line 12). This can be yourmaximum affordable homeloan payment level PITIMaximum Sensible Commission Boost:Fee Treat Coupons:Subtract latest book (Line 10) throughout the down out of theHousing Ratio (row 11) or Debt Proportion (line a dozen) todetermine your PSS count (PSS). You really need to savethis number just like you was indeed currently and then make this new highermortgage fee to exhibit what you can do andwillingness to afford brand new highest mortgage repayment.The new PSS isnt called for if you would like a mortgagepayment maybe not surpassing the affordable most recent rent,unless you are paying your own lease or other expenseswith increased expenses or less the offers. 15hr x 40hrs x52wks a dozen dos,6002. thirty-six,100 a dozen step 3,100 2,600 3,100 5,600 0 0 5,600 (Income) 500 (Debts) step 1,2 hundred 5,600 x .31 1,736 5,600 x .forty – five-hundred step 1,740 step 1,two hundred (PITI) 1,736 step 1,2 hundred 536 (PITI Increase) five-hundred