Missouri: Via the First place Loan Program, accredited earliest-time homebuyers normally receive lower than-markets rates which are up to about three-house out-of a percentage section less than First place financing one include dollars assistance.

Regional apps

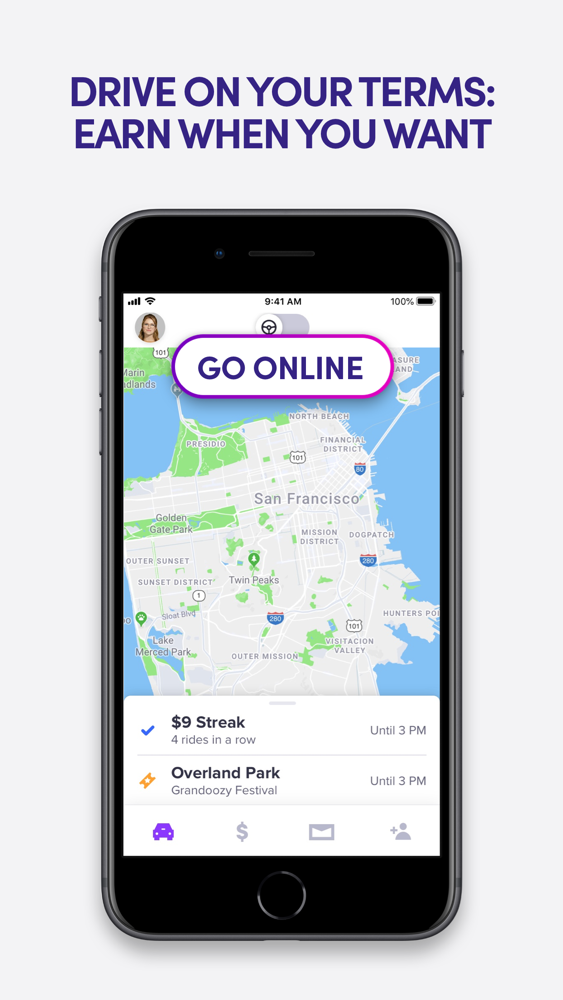

San francisco, CA: The brand new ent has several financial and you may advance payment direction apps to possess first-date home buyers inside the San francisco bay area. The mortgage needs zero repayments having 3 decades, or up until the tool comes. After you apply for the mortgage, you’re tasked a lottery count. Your own number decides when your app could well be processed.

Jacksonville, FL: Through the Jacksonville Houses Loans Power s Very first-Date Homebuyer Program , potential customers could possibly get a fixed-speed, 30-seasons financial with a 1 % origination commission and you may home financing Credit Certification.

Ny, NY: New york city does not have of many first-time domestic consumer applications, although Condition of the latest York Mortgage Company s basic-day home client applications can put on so you can home inside Ny Town. Although not, discover you to preferred New york city-particular program: The fresh HomeFirst Down-payment Guidelines Program . This gives very first-date home buyers just who satisfy specific money requirements an excellent forgivable mortgage all the way to $40,100000 having down payment or settlement costs.

Houston, TX: Houston’s Houses and you will Neighborhood Innovation Institution now offers a couple software having first-go out homebuyers in town. You’re the fresh Homebuyer Guidance Program , which provides as much as $30,100 in deposit assistance in the way of a no-attract, forgivable https://paydayloansconnecticut.com/noroton/ loan in order to money-licensed consumers. The fresh new Harvey Homebuyer Advice System offers the same, but it is intended for Houstonians have been in town whenever Hurricane Harvey struck toward . One another earliest-date home buyers and you can citizens who want to exchange property damaged by Hurricane Harvey qualify for the Harvey Homebuyer Guidance System.

Seattle, WA: Seattle’s Work environment regarding Casing couples that have local teams to provide off percentage assistance to earliest-date homebuyers who will be at the or below 80 per cent of the bedroom average money. The degree of guidelines and you will terms are different in line with the type of away from home while the team you to definitely administers the income. Generally speaking, down payment advice will be up to $55,one hundred thousand.

Mortgage applications to have Local People in america

When you’re Indigenous American, you will find a few specialized applications to purchase property that have a no otherwise low-down percentage. One system is for Local Western veterans, and something is actually for American indian and you can Alaska Native parents.

Local American Lead Mortgage (NADL)

Which mortgage option is having Native American pros as well as their friends players. You erican enrolled in an american Indian tribe otherwise Alaska Indigenous town, a Pacific Islander or a native Hawaiian. (Non-Native Western experts ericans provides resource purchasing, create or redesign residential property for the Government Trust Home. When the acknowledged, there’s no down-payment expected, no personal mortgage insurance rates and you can reasonable closing costs.

Limits: There are strict eligibility requirements to help you be eligible for the newest NADL program. There must be a good Memorandum out-of Information within tribal government and Va regarding your entry to believe places. Additionally, you really must have an effective Va mortgage Certificate from Qualification, meet borrowing requirements and possess proof of earnings getting mortgage and homeownership will cost you.

Indian Home loan Be sure System

Founded because of the Congress inside 1992, brand new Indian Home loan Verify Program is obtainable through the HUD Place of work away from Native Western Programs. This method offers fund that have a low downpayment solution and flexible underwriting to own American indian and you can Alaska Local families, in addition to Alaska communities, tribes or tribally designated property organizations. (Native Hawaiians can also be be eligible for Point 184A financing.) Section 184 funds can be used for home for the or regarding indigenous countries, not all says qualify places.